Thank you for reading this post, don't forget to Join Our Telegram Group! CLICK HERE TO JOIN NEW

Marubozu candlestick pattern

In the exciting world of stock market analysis, there are numerous techniques and tools that traders and investors use to get an edge.

One such tool is the Marubozu candlestick pattern. In this blog post, we will explore the intricacies of the Marubozu candlestick pattern, its meaning, and how to use it effectively in your trading strategies.

Whether you are an experienced trader or a beginner looking to expand your knowledge, understanding the Marubozu candlestick pattern will undoubtedly improve your decision-making process.

What is the Marubozu candlestick pattern?

The Marubozu candlestick pattern is a powerful indicator that can provide valuable insights into market sentiment.

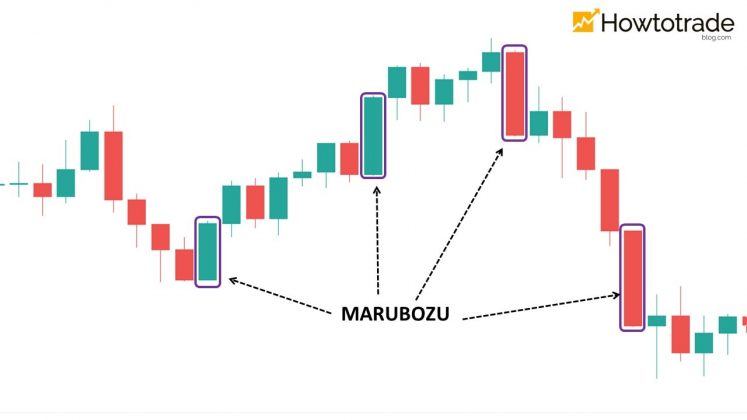

This pattern consists of a single candle with a very long body and little to no shadow or wick at either end.

The absence of shadows indicates strong buying or selling pressure during the trading session and is therefore an important signal for traders.

Types of Marubozu Candlestick Patterns:

Bullish Marubozu:

This pattern occurs when the opening price is the lowest point of the session and the closing price is the highest point. This indicates strong bullish momentum and may indicate the possible continuation of an uptrend.

Bearish Marubozu:

CConversely, the bearish Marubozu pattern occurs when the opening price is the highest point of the session and the closing price is the lowest. This indicates strong bearish sentiment and could indicate the continuation of a downtrend.

Marubozu Candlestick Pattern Analysis:

When analyzing the Marubozu candlestick pattern, several factors should be taken into account:

Body length:

The longer the body, the stronger the buying or selling pressure. A longer body indicates stronger price action and could indicate a more reliable signal.

Volume:

Pay attention to the volume that accompanies the Marubozu pattern. Higher volume strengthens the validity of the pattern and confirms the strength of market sentiment.

Trend confirmation:

It is important to analyze the Marubozu pattern in the context of the prevailing trend. If the pattern is consistent with the overall trend, it reinforces the potential continuation of that trend.

Incorporating the Marubozu candlestick pattern into trading strategy:

The Marubozu candlestick pattern can be used to improve your trading strategies in several ways:

Entry and exit points:

Spotting a Marubozu pattern at key support or resistance levels can serve as an excellent entry or exit signal. It helps traders time their trades more effectively.

Stop loss placement:

Placing stop-loss orders below the low of a bullish Marubozu or above the high of a bearish Marubozu can help protect your positions if the market reverses.

Confirmation with other indicators:

Combining the Marubozu pattern with other technical indicators such as moving averages or oscillators can provide additional confirmation and increase the likelihood of successful trades.

FAQs

How to recognize a bullish Marubozu candlestick pattern?

A bullish Marubozu pattern forms when the opening price is at its lowest point and the closing price is at its highest point, indicating strong bullish sentiment.

What does a bearish Marubozu candlestick pattern mean?

A bearish Marubozu pattern occurs when the opening price is at its highest and the closing price is at its lowest, indicating strong bearish sentiment.

How can the length of the body affect the meaning of the Marubozu pattern?

A longer body in a Marubozu pattern indicates stronger price movement and reinforces the buy or sell pressure signal.

What role does volume play in confirming the Marubozu candlestick pattern?

Higher volume accompanying the Marubozu pattern adds validity to the signal and confirms the strength of market sentiment.

How can the Marubozu candlestick pattern be used in trading strategies?

Traders can use the Marubozu pattern to identify entry and exit points, place stop-loss orders, and confirm signals with other technical indicators.

Can the Marubozu candlestick pattern help determine trend continuation?

Yes, when the Marubozu pattern matches the prevailing trend, it strengthens the potential continuation of that trend.

What are the benefits of including the Marubozu candlestick pattern in the analysis?

The Marubozu pattern provides a simple and strong signal that makes decision making easier and increases the likelihood of successful trades.

How can traders protect their positions using the Marubozu candlestick pattern?

Placing stop-loss orders below the low of a bullish Marubozu or above the high of a bearish Marubozu can help protect positions in the event of a market reversal.

Is it necessary to combine the Marubozu pattern with other indicators?

Combining the Marubozu pattern with other technical indicators such as moving averages or oscillators can provide additional confirmation and improve trading accuracy.

What is a Marubozu candlestick pattern?

The Marubozu candlestick pattern is a single candlestick pattern with a long body and little to no shadow or wick, indicating strong buying or selling pressure.

Diploma:

The Marubozu candlestick pattern is a valuable tool for traders and investors looking to improve their stock market analysis. Its simplicity and powerful signals make it an essential part of every trader’s toolkit.

By understanding the different types of Marubozu patterns and incorporating them into your trading strategies, you can gain a competitive advantage and make more informed trading decisions.

Remember that practice and experience are key to mastering any trading strategy. So,

Start by incorporating the Marubozu candlestick pattern into your analysis, monitor its performance, and refine your approach over time.

Join My Telegram Channel And Dont Forget To Share